When should you start raising preseed funding?

Understanding the Landscape

The Startup Ecosystem: The startup world is a high-stakes game, one where timing is as crucial as the idea itself. Aspiring entrepreneurs often grapple with a fundamental question: when to start raising pre-seed funding. In the words of Scott Galloway, “Money is a commodity, but the timing and strategy behind it are not.”

For a more in-depth analysis, review the

Understanding the Landscape for Raising Pre-Seed Funding article.

The Pre-Seed Stage: A Definition

Pre-Seed Defined: Pre-seed funding is often the first stage of venture financing. It’s the “seed” that germinates your business idea. Typically, this phase involves small amounts of capital to support market research, product development, and building a team.

Timing Your Move

Market Conditions: Assess the market environment. A saturated market might require quicker funding to gain a competitive edge, while a novel concept might need more development time before seeking funds.

Maturity of the Idea: Galloway often emphasizes the maturity of the business idea. An underdeveloped idea can lead to premature funding and misallocated resources.

Your Readiness: Are you ready to pitch? Investors look for confidence and clarity. Ensure your business plan, pitch deck, and financial forecasts are in top shape.

For a more in-depth analysis, review the Timing Your Move for Pre-Seed Funding article.

The Approach: Data-Driven Decision Making

The approach should be deeply rooted in analyzing market data and trends. Let’s dive into some key data points:

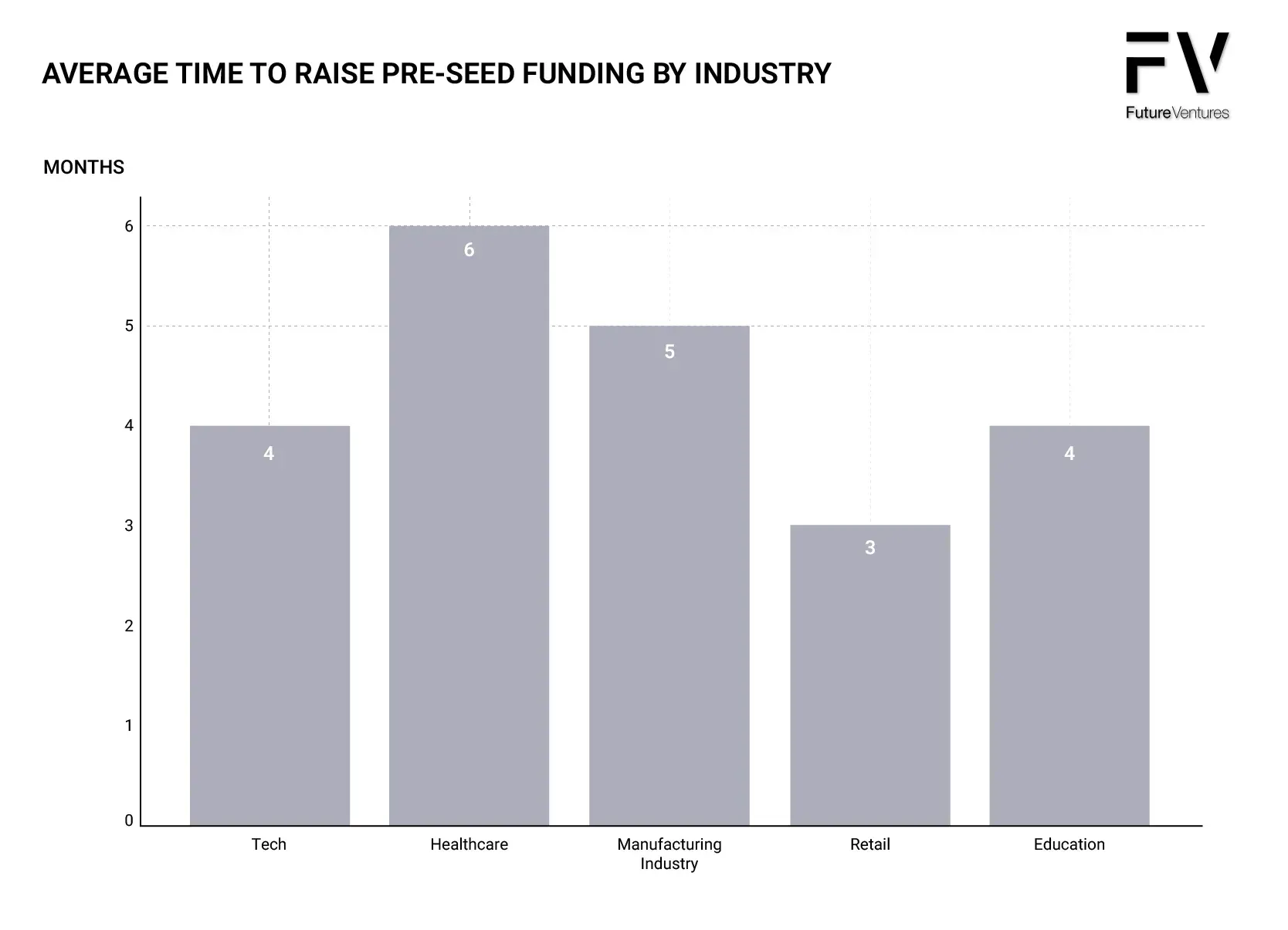

- Average Time to Raise Pre-Seed Funds: Historically, it takes about 3-6 months to secure pre-seed funding.

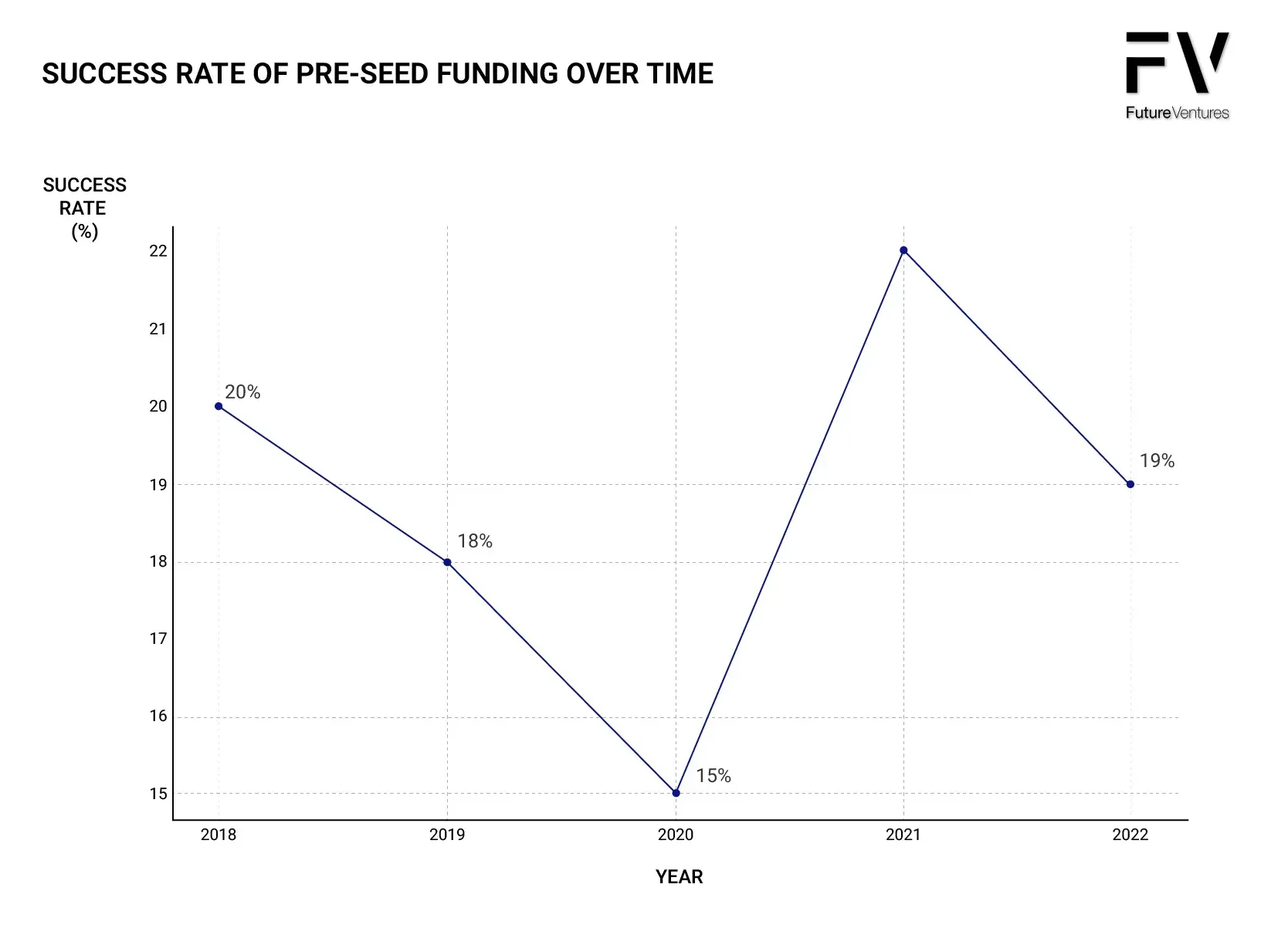

- Success Rates: Only a small percentage of startups successfully raise pre-seed funding. Knowing this can help set realistic expectations.

- Industry Trends: Different industries have different timelines. Tech startups might move faster than those in manufacturing.

The graph above represents the "Average Time to Raise Pre-Seed Funding by Industry". It shows a comparative view of how long, on average, startups in different industries take to secure pre-seed funding. This visualization is crucial for understanding industry-specific dynamics and preparing for the funding journey accordingly.

The graph above depicts the "Success Rate of Pre-Seed Funding Over Time" and provides insights into the trends and success probabilities for startups seeking pre-seed funding across from 2018 to 2022. These trends provide valuable context for understanding the changing landscape of startup financing, highlighting the years when startups were more or less likely to succeed in their initial funding efforts.

The Role of Networking

The power of networks. Building a strong network can accelerate the funding process. Engage with potential investors, industry experts, and fellow entrepreneurs early on.

For a more in-depth analysis, review the

The Role of Networking in Raising Pre-Seed Funding article.

The Financial Aspect: How Much to Raise?

Calculating Your Needs: Don’t just pull a number out of thin air. Calculate your runway – how long the funding will keep your startup afloat.

For a more in-depth analysis, review the

The Financial Aspect: How Much to Raise for Pre-Seed Funding article.

Risk and Reward

Understanding the Risks: Pre-seed funding often comes with high expectations. Be aware of the equity you’re giving up and the pressure to deliver.

For a more in-depth analysis, review the

Risks and Rewards of Raising Preseed Funding article.

Final Thoughts: The Art of Timing

The right time to raise pre-seed funding is a confluence of market readiness, idea maturity, personal preparedness, and financial necessity. It’s not just about having a great idea, it’s about having it at the right time.

References

- Industry Reports on Startup Funding

- Market Analysis Data